The Author: Anne Golombek

The Author: Anne Golombek

Anne Golombek is COO and Marketing Lead at minubo, the Commerce Intelligence Company. As an expert in data-driven commerce, she is one of the initiators of the Commerce Reporting Standard project.

“In the end of the day, it all comes down to revenues and profits.” That’s classic commerce controlling. And it’s not entirely wrong as revenue is what goes to your bank account and profit is what actually stays there. BUT: Nowadays, you will never be able to determine, if your business model actually works (or: keeps working) with these metrics, because they’ve nothing to do with the actual substance of your business that decides whether it will live or perish: Your customers.

Customer Base Disease Must be Diagnosed Early

If your customer base and its development aren’t healthy, your business is neither. It’s as simple as that. And even more important: If your business isn’t healthy, you don’t have until forever to cure it. Customer base disease is like an infection that you can only cure in the early phases as its negative effects are mutually reinforcing. That’s hard, but leaves a crucial takeaway: You have to diagnose early. The problem: You won’t see the symptoms of the disease in your P&L results for a long time, as (again) aggregated revenues and profits don’t reflect the actual structure of your business. For early diagnosis, you mustn’t look at the overall results, but at the decisive drivers of your business: Your customers.

The most surprising thing about the fact that, despite of all that, revenues and profits still seem to be the sole center of commerce controlling is that it truly is no news that today’s markets are all about the customer. They’ve been shouting it from the rooftops for quite some years already that the customer is the most critical element of commerce businesses (quite obvious, actually, as he/she is the one who’s supposed to give you the money) and that in times of GAFA gate-keepers it’s absolutely crucial to ensure both stabilization and expansion of new customer access and, most of all, exploitation of existing customers’ value potential. So with that given, one should think it was self-evident that strategic performance measurement and forecasting in commerce companies follows exactly these terms, right? Well – it’s not: Judging from our experience and the experience of our partners, strategic performance measurement and forecasting are still a question of revenues and profits.

This is why we as a group of commerce data nerds sat down to put our heads together and finally came up with what we think is needed most: A customer-centric view on business vitality that uses the actual determinants of commerce businesses to measure their success, validate their long-term stability and forecast their development. In short, we call it the Business Vitality Model.

The Idea: True Transparency With Annual Customer Cohorts

The basic idea of the business vitality model is to purposefully monitor customer base development by looking at annual customer cohorts broken up by several key metrics. These cohorts can then be summarized to their key insights – e.g. to the initial repurchase rate of every annual cohort that, looked at across multiple years, shows how sustainable the buildup of your customer base actually is. By gathering these kinds of insights, the development of your actual business substance stays very transparent at any time.

The very basis to start with would be the following two metrics that give you a first overview on how sustainable your customer base develops:

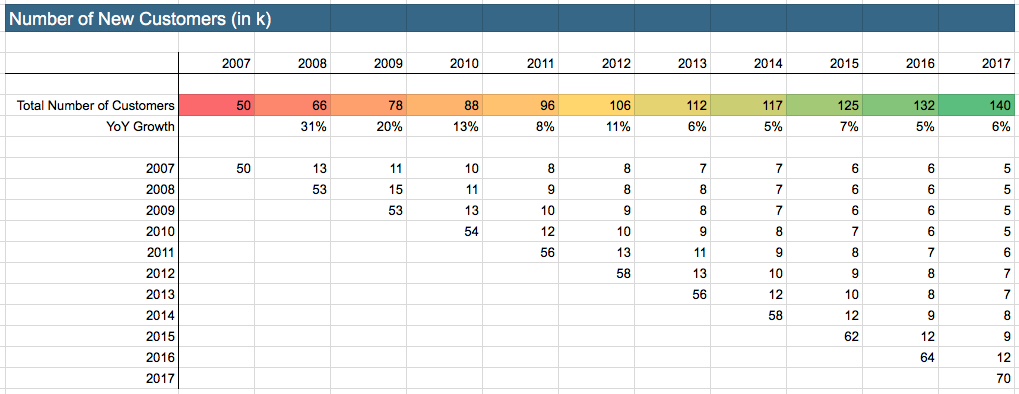

- Number of new customers: How many new customers do I acquire each year and how many of them buy again in each following year? Looked at in annual cohorts, this does ultimately result in a broken-down view of your total customer base (see image 1).

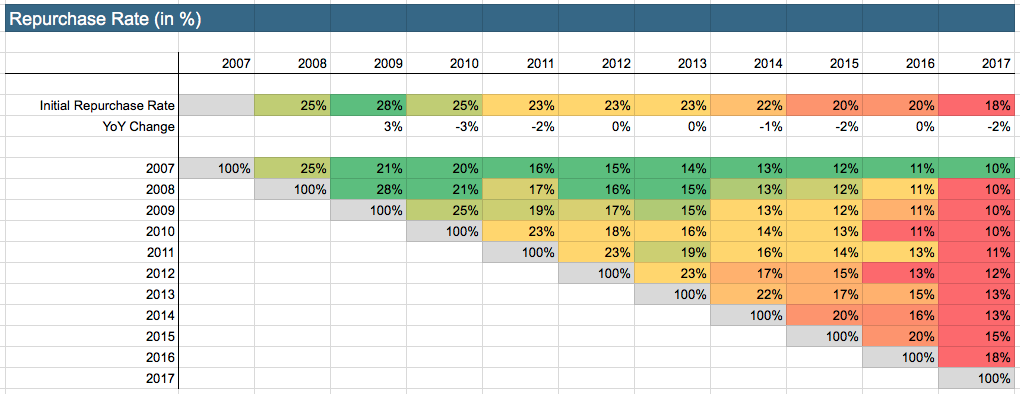

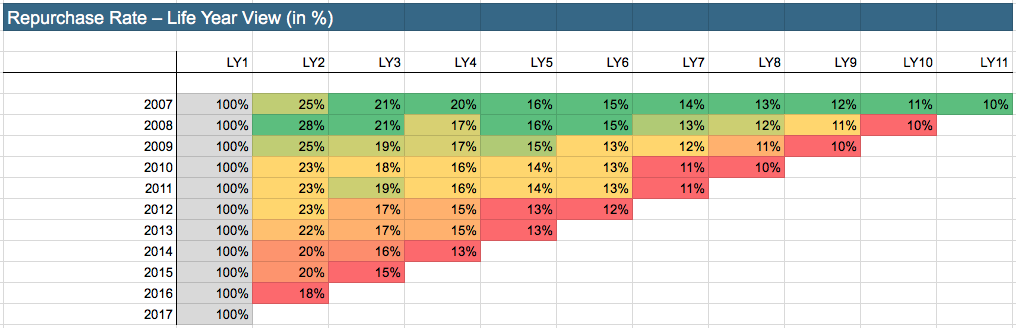

- Repurchase rate: This is basically a different view of the same issue – expressed in percentages instead of total numbers. Which percentage of my newly acquired customers per annual cohort buys again during the following years (image 2)? Looked at in life year view (image 3), the key insights might become even clearer here than in simple cohort view.

Have a look at the customer cohorts of our sample business to get a first idea of how the model works – we’ll go deeper into model details and calculations in our next article.

Image 1: Number of new customers in cohort view

Image 2: Repurchase rate in cohort view

Image 3: Repurchase rate in life year view

.

A Change of Viewpoint Delivering Crucial Insight

The samples already indicate the impact that this change of viewpoint can have:

If you just look at the development of the total customer base (image 1, coloured row – numbers you’d most likely have in classic commerce controlling, too), you’d see a more or less positive picture: Though the growth rates aren’t constant, the total customer base is still growing from year to year. In addition to that, you’d probably see growing revenue figures in your P&L. As a consequence from viewing these numbers, you’d maybe try to make the growth of your customer base more constant (and rapid) by investing in new customer acquisition campaigns.

BUT: A closer look with the help of the Business Vitality Model (especially in image 2 and 3) shows where the growth of the customer base actually comes from: What grows here is the number of newly acquired customers per year – the repurchase rates of these customers on the other hand are decreasing from year to year. This implicates a strong and dangerous loss of business substance and sustainability: New customers are bought (with probably strongly increasing cost), but cannot be converted into sustainable business value. You could say that this kind of growth is a hollow one: You have more and more cost (acquiring new customers) with short-term results (initial revenues), but less and less actual value (no retention, no long-term business substance) – a serious case of customer base disease that would probably not have been diagnosed with the means of classic commerce controlling. Let’s hope it’s not too late for the cure.

Same Logic, new Metrics: Dig Deeper

On this basis, the model proceeds with applying the same logic to further metrics to dig deeper and deeper into the case and make business developments and their dynamics truly understandable – like an x-ray that doesn’t just show the surface of things (like classic commerce controlling tends to do), but also screens the insides, down to the very core.

We’ll go more into detail with that during our next article – explaining the concrete calculations and further metric break-downs provided by the model. How to bridge the gap between the pure size of the customer base and monetary values? And how to find a way from high-level numbers to actionable insights?

A New Way of Planning

Although we did not go into the details of the model yet, you might already see the implications it can have for the reliability of business forecasting: Instead of planning with aggregated growth rates applied to e.g. customer base size, revenue, costs and profits, you’re now able to develop plans the other way round: If you see the development of the actual drivers of your business in full transparency (e.g. repurchase rates, cart sizes, return rates or discount rates) provided by the annual cohort development view (in x-ray mode, so to speak), you can make well-founded predictions for the upcoming years and, finally, also derive informed forecasts in the aggregated P&L view.

Rethinking Data-Driven Commerce

With all of that given, our understanding of data-driven commerce is evolving to the next level: It’s not about the old dynamics between departments and controlling anymore (with controlling coming up with some numbers and departments throwing their hands up in despair to then run after some goals that have nothing to do with day-to-day business reality), but about well-founded strategic planning derived from actual, operational business drivers that is thoroughly evaluated and then systematically broken down back into operational goals. The operational stakeholders, in turn, have to be equipped with easy access to relevant business data to be able to dig deeper into their numbers, derive actionable insights and monitor goal achievement.

With a setup like that, you’ll have the best chance of being spared from customer base disease: It’s the way to not only diagnose early, but also to cure quickly and effectively – with a fully data-driven way of working that connects the entire organization on both strategic and operational levels.

Discuss With us – Online or in our Workshop!

What do you think about these ideas? Don’t hesitate to share your thoughts – via the comment section below or in person during our workshop about the Business Vitality Model:

November 8th, 2018 – 10am–5pm

Project A offices, Berlin

Sign up here: commerce-reporting.com/bvm-workshop

We’re looking forward to meeting you!